Noncurrent Assets

The curiosity revenue can be reported in the same method typically used to report another interest revenue. The avoidable curiosity %keywords% is set by multiplying (an) rate of interest(s) by the weighted-average amount of accrued expenditures on qualifying belongings.

Prepaid Assets

Knowing how much a business owes in addition to how a lot they’re owed and when payments should be made or acquired lets businesses have an idea of their cash move over the next several months. It also makes positive that businesses have enough money in the bank for business funds which could possibly be something from salaries, to lease as well as other overhead payments.

Are intangibles current assets?

Current assets include items such as cash, accounts receivable, and inventory. Property, plant, and equipment – which may also be called fixed assets – encompass land, buildings, and machinery including vehicles. Finally, intangible assets are goods that have no physical presence.

Noncurrent Assets Between Industries

In other words, the relationship that a debtor and a creditor share is complementary to the connection that a buyer and supplier share. Products and providers might often be prohibitively expensive to pay for up entrance, or in a single lump sum. Financing allows a person https://www.binance.com/ or business to have use of the asset whereas paying for it in additional manageable instalments – often weekly, month-to-month, or typically quarterly. The benefit for the debtor is that they get access to funds or tools that may otherwise be beyond them.

Are debtors current assets?

“Current Assets” include cash, bank balances and assets you expect to convert into cash like stock and debtors. Debtors are people who owe you money. In the case of “Trade Debtors”, this will include any outstanding amounts your clients owe you.

How Do Tangible And Intangible Assets Differ?

Plant property are recorded at their price and depreciation expense is recorded during their useful lives. Your remaining assets and liabilities are generally combined into two or three other secondary captions, based mostly on their materiality. In apply, essentially the most broadly used title is Balance Sheet; nonetheless Statement of Financial Position is also acceptable. Naturally, when the presentation contains more than one time interval the title “Balance Sheets” ought to be used.

- Current property are short-time period assets, whereas mounted property are sometimes long-term assets.

- Current belongings and stuck belongings are listed on the stability sheet.

- Capital investment may embrace purchases of kit and machinery or a brand new manufacturing plant to increase a business.

- In brief, capital investment for fixed property means the company plans to use the assets for a number of years.

- Most mounted belongings, exterior of land, need to repaired and maintained.

- The balance sheet exhibits an organization’s sources or assets whereas also exhibiting how these assets are financed whether by way of debt as proven under liabilities or by way of issuing fairness as proven in shareholder’s fairness.

The amount of depreciation taken for a plant asset is often recorded within the accounting data at the beginning of the fiscal interval. The original price of a plant asset much are plant assets current assets less its accumulated depreciation. Is the total amount of depreciation for a plant asset that has been recorded as much as a selected point in time.

Noncurrent property may be subdivided into tangible and intangible belongings—such as fastened and intangible assets. Business transactions, at their easiest, have two events concerned that are the creditor and debtor. In quick, a creditor is someone who lends cash whereas a debtor is someone who owes cash to a creditor. Ensuring the graceful move of working capital is completed https://cex.io/ by an organization preserving observe of the time lag between the receipt of fee from the debtors as well as payment of cash to the creditors. Creditor days are used to measure an organization’s creditworthiness in addition to popularity and to a sure diploma, creditor days determines the latitude allowed by its suppliers in addition to creditors.

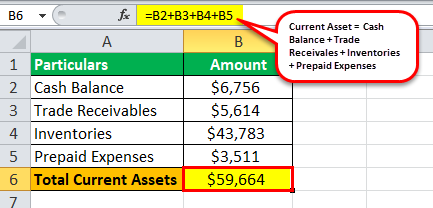

Companies generally won’t place patents on their balance sheet unless they purchased these patents from someone else. To go on the balance sheet, an asset has to have an objectively determinable worth. A patent that is internally generated by a company would not have an goal worth; one which’s been sold has such a price — the sale worth. The present property of XYZ Limited for the yr ended on March 31, 20XX is $191,000. Let’s see some easy to advanced instance to understand the calculation of Current Assets Formula better.

Typically, a standard stock investor is going to be happiest when the inventory market heads down if she owns a large, profitable enterprise with monumental cash reserves and little to no debt. Such a strongly capitalized enterprise can benefit from a tricky financial climate to purchase up competitors for a fraction of their true worth.

To see how accounts payable is listed on the balance sheet, below is an instance of Apple Inc.’s steadiness sheet, as of the top of their fiscal 12 months for 2017, from their annual 10K statement. Accounts receivable are just like accounts payable in that they each provide phrases which may be 30, 60, or 90 days. However, with receivables, the corporate shall be paid by their clients, whereas accounts payables represent https://cryptolisting.org/blog/what-are-plant-assets money owed by the company to its creditors or suppliers. Accounts payableis the amount of brief-term debt or cash owed to suppliers and collectors by an organization. Accounts payable are brief-term credit obligations bought by a company for services and products from their supplier.

Are Patents current assets?

A patent is the exclusive right to market a particular invention. A patent definitely meets the balance-sheet definition of an asset, which is something of future economic value to a company, but patents don’t qualify as current assets.

For the portion of weighted-common amassed expenditures which is larger than specific debt incurred, the rate of interest is a weighted average of all other interest rates incurred. The amount of curiosity to be capitalized is the avoidable curiosity, or the actual curiosity incurred, whichever is decrease. As indicated in the chapter, an alternative %keywords% choice to the particular rate is to use a median borrowing fee. Assets that don’t qualify for interest capitalization are assets which might be in use or ready for their supposed use, and property that aren’t getting used in the earnings actions of the firm.

If a company receives gear in trade for newly issued shares of stock, the noncurrent asset Equipment will enhance and Contributed Capital will improve. In the case of auction are plant assets current assets-price securities, the failure price was exceedingly excessive, and the use of auction-price securities as a present asset considerably declined.

“Current Assets” embrace cash, financial institution balances and belongings you count on to transform into money like inventory and debtors. One of the good options of the Crunch on-line accounting software program is the ability to generate actual-time monetary reports.

Asset costs pertaining to land embody buy worth, property taxes, closing costs, broker fees, excavation and different comparable prices necessary to make the land usable. Some firms may have a much larger percentage of plant belongings than others. As you may need guessed, these are usually industrial corporations or corporations that deal with bodily products. Intangible belongings do not seem on steadiness sheets but (depending on the business) may make up a considerable part of the asset value of a enterprise.